Pune: Bajaj Allianz Life has announced the launch of the Bajaj Allianz Life BSE 500 Enhanced Value 50 Index Fund, a New Fund Offer (NFO) exclusively available under its Unit Linked Insurance Plans (ULIPs). The NFO is open until September 20, 2025.

The Bajaj Allianz Life BSE 500 Enhanced Value 50 Index Fund is designed to provide long-term capital appreciation by investing in equities that are part of the BSE 500 Enhanced Value 50 Index. The fund also provides ULIP policyholders with the dual benefits of disciplined investing and life insurance protection.

Bajaj Allianz Life BSE 500 Enhanced Value 50 Index Fund Aims at Value-Based Equity Growth

The investment framework leverages three fundamental financial ratios to identify undervalued companies:

- Book-to-Price Ratio: Highlights strong asset base relative to market price.

- Earnings-to-Price Ratio: Indicates robust earnings potential compared to valuation.

- Sales-to-Price Ratio: Reflects solid revenue generation relative to market capitalization.

This diversified approach helps avoid overreliance on any single metric, ensuring balanced portfolio construction.

Also Read: Axis Mutual Fund Launches Axis Nifty500 Quality 50 Index Fund

Passive Management and Quarterly Rebalancing for Stability

The Bajaj Allianz Life BSE 500 Enhanced Value 50 Index Fund is passively managed, replicating the BSE 500 Enhanced Value 50 Index.

It undergoes quarterly rebalancing to align with updated market data and trends. This allows investors to maintain systematic, long-term exposure to high-potential value stocks with minimal active management risk.

Srinivas Rao Ravuri, Chief Investment Officer, Bajaj Allianz Life Insurance, said: “The Bajaj Allianz Life BSE 500 Enhanced Value 50 Index Fund offers investors a disciplined path to value investing, a strategy that has historically rewarded long-term commitment.

Also Read: Tata AIA Momentum 50 Index Fund to Combine Wealth Creation with Life Protection

By systematically investing across large, mid, and small-cap companies with attractive valuations, the fund provides diversified equity exposure with a balanced risk-reward profile. This approach can support sustainable wealth creation for investors over time.”

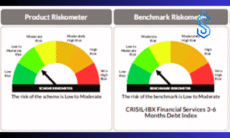

Suitable for Long-Term, High-Risk Investors

The fund is targeted at investors with a high-risk appetite seeking long-term capital appreciation through systematic, rule-based strategies. Integrated with Bajaj Allianz Life’s ULIP products, the fund not only supports wealth creation but also offers the added security of life cover.